You’ve gathered your payroll reports, trust statements, census data, plan documents, and every other scrap of paper your CPA asked for. You’ve met your responsibilities—and probably exhaled with relief.

As the plan sponsor, you’ve done your part. Now make sure your 401(k) auditor is doing theirs.

But here’s the truth: even if you’re fully buttoned up, you can still miss the October 15 Form 5500 deadline if your auditor isn’t moving quickly enough right now. The penalties for missing that deadline aren’t small change—up to $25/day from the IRS (max $15,000) and $2,529/day from the DOL with no cap.

August is the make-or-break month. If your auditor hasn’t made significant progress by now—or worse, has gone quiet—you might be headed for trouble, through no fault of your own.

What Your 401(k) Auditor Should Be Doing

Here’s the rough timeline of where your CPA should be in the audit process if you’ve already provided all the requested documents.

Late July/Early August: Fieldwork Underway or Completed

- Testing employee and employer contributions for accuracy

- Checking timeliness of deposit of employee deferrals

- Reviewing eligibility and participation rules were applied correctly

- Verifying benefit payments and loan distributions

- Performing initial compliance and internal control testing

Late August: Drafting the 401(k) Audit Report

- Summarizing test results

- Documenting any findings or exceptions

- Preparing preliminary recommendations for corrections (if needed)

- Drafting financial statement footnotes

Early September: Delivering Draft Financial Statements to You

- Providing the draft financial statements for your review

- Allowing time for you and your TPA to review and comment

- Resolving any outstanding questions or documentation gaps

Questions to Ask Your 401(k) Auditor Right Now

Use these questions to quickly gauge whether your audit is on track:

- Where are you in the fieldwork process?

(If they haven’t started yet, that’s a big red flag.) - When will we receive the first draft of the financial statements?

(You should expect this no later than early September.) - Are there any open items or issues you’re waiting on from us or the TPA?

(You want to clear any bottlenecks immediately.) - What’s the timeline between delivering the draft and issuing the final audit report?

(There should be at least a week buffer before October 15.) - Do you see anything that might delay the Form 5500 filing?

(Better to know now than on October 10.)

What to do if Your 401(k) Auditor is Behind

If your auditor is vague, non-committal, or clearly behind schedule:

- Push for a detailed timeline in writing.

- Involve your TPA to help coordinate and remove any blockers.

- Escalate within the CPA firm—ask to speak with the engagement partner if needed.

The 401(k) Audit Bottom Line

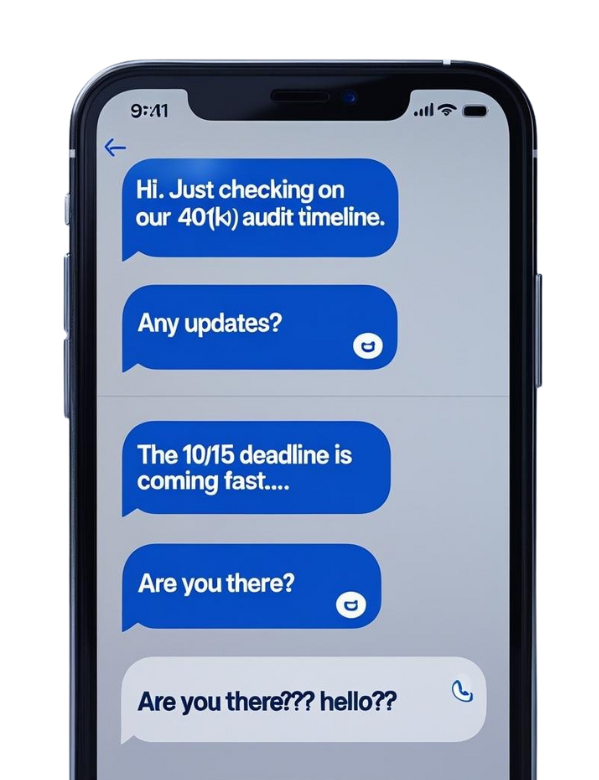

In August, your 401(k) auditor should be testing, drafting, and communicating—not ghosting you. A silent auditor is a dangerous auditor so close to the deadline.

If you’re getting vague answers, missed milestones, or no communication at all, don’t wait—escalate. You’ve already done your part. At this stage, it’s about holding your auditor accountable so you’re not paying thousands in penalties for someone else’s delay.

At PriceKubecka, our process ensures clients never have to ask these kinds of questions. We keep you informed, on schedule, and confident your filing will be completed on time. If you’re facing delays or last-minute panic with your current auditor, CONTACT US. We’ll do everything we can to help you avoid costly IRS and DOL fines, even this late in the game.