Avoiding Costly 401(k) Compensation Errors: A Guide for HR, Payroll, Finance Professionals

401(k) retirement plans are powerful tools for helping employees save for the future, but they also come with a minefield of regulatory requirements—especially when it comes to one deceptively complex concept: compensation.

If you’re involved in your company’s 401(k) plan, understanding how compensation is defined and applied in your plan documents is critical. Why? Because compensation-related errors are among the most common findings in retirement plan audits—and they can be costly, time-consuming, and frustrating to fix. In fact, more than half of the plans PriceKubecka audited last year had some form of compensation-related mistake. But here’s the good news: nearly all of them can be prevented with the right knowledge and a few smart practices.

Understanding the Definition of Compensation

It all starts with your plan documents—specifically your adoption agreement and basic plan document. These documents define what counts as “compensation” for plan purposes, and they must be followed to the letter.

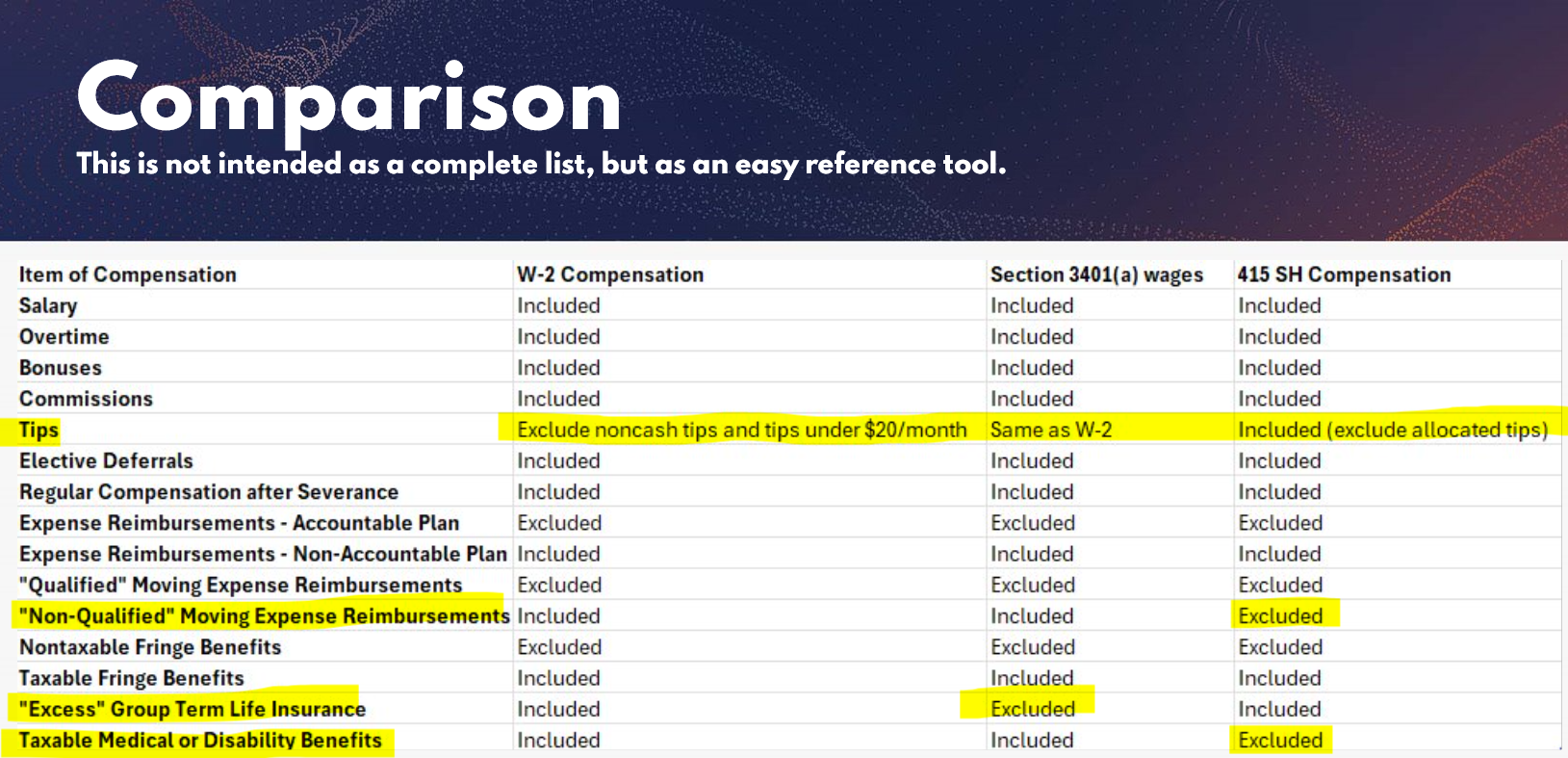

Common Definitions of Compensation:

- W-2, Box 1 Wages: Most frequently used. Includes taxable wages reported on the employee’s W-2.

- Code §3401(a): Similar to W-2 wages but excludes certain items like the cost of group-term life insurance.

- 415 Safe Harbor Compensation: Broader definition that can include pre-tax deferrals and certain tips.

Be Careful with Compensation Exclusions

Your plan may start with a standard definition of compensation, like W-2 Box 1 wages—but it’s common for employers to want to exclude certain types of pay, such as:

- Bonuses

- Commissions

- Overtime

- Fringe benefits

- Reimbursements and allowances

Here’s where things get tricky: applying exclusions that aren’t clearly written into your plan documents can create compliance issues. We’ve seen many employers consistently exclude things like bonuses or commissions from deferrals, assuming it’s okay because “that’s how it’s always been done” or “employees prefer it that way.” But unless the exclusions are formally documented in your adoption agreement or basic plan document, you’re likely out of compliance—even if your practice seems reasonable.

Bottom line: If your plan documents say all W-2 wages are included, then you must calculate deferrals based on all W-2 wages—unless specific exclusions are clearly authorized. When in doubt, clarify your documents or update them to match your actual practices.

Common Mistakes PriceKubecka Sees in Your 401(k) Audit

- Improper Inclusion/Exclusion of Pay Codes: New pay types (like commission or PTO payouts) are added but not configured to calculate deferrals.

- Post-severance pay: Forgetting that commissions paid after termination might still be deferrable.

- Fringe benefits: Confusion about whether something like a gift card or car allowance counts as compensation.

- Manual and Off-Cycle Checks: Manual payments and adjustments often bypass the deferral logic set up in payroll systems.

- Post-Severance Pay Confusion: Pay issued after termination may still be eligible for deferrals, depending on how your documents define it.

- System transitions: Changing payroll providers and failing to mirror deferral logic from the old system to the new.

Made a Mistake? Here’s How to Fix It.

The IRS offers three main correction programs, summarized in its Fix-It Guide:

- Self-Correction Program (SCP)

Fix the error internally without notifying regulators. Best for small or recent mistakes. - Voluntary Correction Program (VCP)

Notify the IRS and correct the issue officially. Use this when the problem is widespread or involves large sums. - Audit CAP (Correction Under Examination)

If regulators find the error first, you’ll correct it under their supervision—usually the least desirable option.

What Can You Do to Prevent Errors?

Simplify Plan Documents: Avoid overly complex definitions. Choose a compensation definition that matches your payroll structure and employee demographics.

Clean Up Earning Codes: Review and eliminate outdated or unnecessary earning codes to prevent confusion and reduce audit risk.

Provide Staff Training: Train payroll teams to read and interpret plan documents, especially before changes in systems or processes.

Spot Check Regularly: Perform internal reviews annually or semi-annually, especially if you use lots of earning codes or frequently issue manual checks.

Use Payroll System Changes as an Opportunity: When switching providers, review your plan documents and align them with current payroll practices. This is a great time to clean house.

Who Can Help?

Navigating compensation definitions and correcting errors in your 401(k) plan can feel overwhelming—but you’re not alone. The right partners can make all the difference.

Payroll Providers can:

- Ensure your earning codes are mapped correctly to reflect eligible compensation.

- Help configure deferral rules across regular, off-cycle, and manual checks.

- Support with system setup during provider transitions to prevent deferral calculation errors.

Recordkeepers and TPAs (Third-Party Administrators) can:

- Interpret plan documents and clarify what is and isn’t included as eligible compensation.

- Help draft amendments when your practices don’t align with your documents.

- Guide you through IRS correction programs like SCP or VCP when needed.

💡 Pro Tip: TPAs are especially valuable when simplifying overly complex definitions or aligning your plan with how your company actually pays people.

While they often bring the bad news, auditors are your first line of defense in catching issues before regulators do. A good auditor like PriceKubecka will:

- Perform full-population testing of payroll data (not just sample testing).

- Help identify patterns of compensation errors (e.g., missed bonuses, severance pay issues).

- Offer practical advice to prevent repeat errors in future years.

💡 Pro Tip: Don’t view the audit as just a compliance requirement—it’s a key opportunity to strengthen your controls.

When you’re in a legal gray area or need to evaluate your compliance posture, ERISA counsel can:

- Review your plan documents in-depth to determine what’s actually allowed.

- Help interpret contradictory language between your adoption agreement and basic plan document.

- Prepare formal responses to regulators or assist with voluntary correction filings.

Get Ahead of Small 401(k) Compensation Issues Before They Become a Big Problem

Compensation mistakes aren’t just a headache to address—they can also become costly. But with the right tools and habits, you can catch them early or avoid them entirely. And if you’ve inherited a mess, don’t panic—partner with your auditor, provider, and legal team to clean it up and put strong controls in place moving forward.

Need help navigating a compensation issue in your 401(k)? We’ve audited hundreds of 401(k) plans and helped many companies identify, correct, and prevent these exact problems. From full population testing to practical guidance on corrections, we’re here to help. Let us know how we can support your team in keeping your 401(k) plan compliant, accurate, and working in your employees’ best interests.